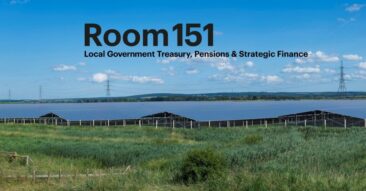

Quinbrook Secures Tesco and Shell Offtake Agreements from UK’s Largest Consented Solar + Battery Storage Project

Tesco Stores Limited (“Tesco”) and Shell Energy Europe Limited (“Shell”) sign full offtake agreements for Cleve Hill Solar Park which is expected to power the equivalent of over 102,000 homes

Tesco’s commitment is the largest corporate PPA for solar power in the UK to date

London – 16 October 2024 – Quinbrook Infrastructure Partners (“Quinbrook”), a specialist global investment manager focused exclusively on the infrastructure needed for the energy transition, today announced two long-term offtake agreements with Tesco and Shell covering 100% of the solar power generation from its Cleve Hill Solar Park (“Cleve Hill”). Cleve Hill, a 373MW solar + 150MW battery storage project, is the largest to ever be constructed in the UK and is due to commence operations in early 2025

The offtake agreements secured with Tesco and Shell are a testament to this landmark renewables project for the UK and represent a significant milestone in delivering long-term inflation linked revenues for our investors, supporting new construction and jobs. Cleve Hill has set new benchmarks for UK solar and helps Quinbrook further its efforts to support the UK’s decarbonisation goals and energy independence through large-scale solar + battery storage projects.

Keith Gains

Managing Director and UK regional lead for Quinbrook

Quinbrook’s 15 Year Power Purchase Agreement (PPA) with retailer Tesco, is the largest solar corporate PPA executed in the UK to date and will account for 65% of the expected solar generation from Cleve Hill once operational.

Shell, a major power and renewables certificate trader and provider of route to market services, has signed a ten-year Route to Market agreement with Quinbrook to manage 100% of the capacity that was secured by Quinbrook under a 15-year Contract for Difference (“CfD”) in July 2022 as part of the UK’s Allocation Round 4, equivalent to 35% of the expected solar generation from Cleve Hill. This CfD contract award was the largest received by a UK solar project as part of the biggest ever round of the UK government’s flagship auction scheme at the time.

Both offtake agreements provide long term index-linked revenues for Cleve Hill, offering revenue certainty for Quinbrook investors and a hedge against rising inflation which delivers on the key features of a sustainable infrastructure investment helping to accelerate the UK’s energy transition.

“We’re delighted to be announcing such a significant step in our journey towards carbon neutrality across our own operations by 2035. Cleve Hill solar park, with its ability to generate up to 10% of our UK electricity demand, joins a number of other Power Purchase Agreements we’ve announced over the last five years. With its ability to provide vital energy storage infrastructure, it’s a key part of the renewable energy strategy in the UK, and further evidence of our commitment to tackle climate change and source green electricity from innovative projects like this,” said Ken Murphy, Group Chief Exec, Tesco.

“Shell is pleased to work with Quinbrook to manage a proportion of the Cleve Hill capacity and further expand our UK PPA portfolio. Combined solar and battery storage projects such as this have a vital role to play in driving forward the UK’s transition to a flexible and low-carbon energy future,” said Rupen Tanna, Head of Power and Systematic Trading for Shell Energy Europe Limited.

Cleve Hill was granted development consent in May 2020 by the UK Department for Business, Energy & Industrial Strategy and was the first of its kind to be approved as a Nationally Significant Infrastructure Project. Cleve Hill, once operational, is expected to generate enough renewable power each year to meet the power needs of 102,000 UK homes and help reduce carbon emissions by more than 142,000 tonnes in the first year of operations, equivalent to the carbon sequestered by more than 2.3 million tree seedlings grown for 10 years. In addition to climate impact, the project also seeks to deliver a net gain of over 65 percent in biodiversity onsite, and is also expected to support over 2,300 direct and indirect jobs and generate more than GBP 143 million in local Kent socio-economic benefits over its lifetime.

About Quinbrook

Quinbrook Infrastructure Partners (http://www.quinbrook.com) is a specialist investment manager focused exclusively on the infrastructure needed to drive the energy transition in the UK, US, and Australia. Quinbrook is led and managed by a senior team of power industry professionals who have collectively invested c. USD 5.6 billion of equity capital in 43.3 GW of energy infrastructure assets representing a total transaction value of USD 48.3 billion. Quinbrook has completed a diverse range of direct investments in both utility and distributed scale onshore wind and solar power, battery storage, reserve peaking capacity, biomass, fugitive methane recovery, hydro and flexible energy management solutions in the UK, US, and Australia. Quinbrook is currently developing and constructing some of the largest renewables and storage infrastructure projects in the UK, US, and Australia.

Media Contact:

Jennifer Pflieger

+1 (212) 446-1866

Related News and Insights

See all

Quinbrook recognised at IJInvestor Awards 2024

Quinbrook Announces Multiple MD Promotions

Quinbrook Launches Quintrace Platform

Imperial Climate Challenge in 4 Questions

Quinbrook Welcomes Bipartisan US Congressional Delegations to its Flexitricity Headquarters

Flexible Generation, Grid Support | United States | United Kingdom | Global *

Wood Mackenzie scales data analytics across the energy transition by adding Quinbrook

Industry | United Kingdom | Global *

Quinbrook joins the Net Zero Asset Managers initiative

Net Zero | United States | United Kingdom | Australia | Global *

Investor login

Investor login